Natural diamond industry performing well despite less positive narrative

Based on diamond miner equities, sentiment surrounding the diamond industry is currently at a historically low level, says diamond analyst Paul Zimnisky. However, global diamond jewellery sales have been growing at a steady rate, in nominal and real terms, for the past nine years, he adds.

In a report released on his website last week, he notes that, "over the past two years, a basket of diamond producer stocks was down 28.9% in 2018, following a decline of 17.3% in 2017. . . [owed] to idiosyncratic operational challenges that most miners are dealing with in one way or another.”

Investor sentiment is “undeniably low” by valuation standards projected by future diamond price expectations, which has led to concerns spanning the industry’s future growth prospects and overall longer-term economic viability, notes Zimnisky.

“The ultra-successful ‘A Diamond is Forever’ marketing campaign has been discontinued for over a decade now, and so have many of the positive attributes of diamond ownership in consumers’ minds”, Zimnisky suggests that the “glamorous cultural perception” of diamonds has faded and has been somewhat supplanted by images of civil rights abuses and “monopolistic practices”.

Nonetheless, the growing “financial liberation” of middle-class consumers in developing economies, the positive global gross domestic product growth and the continued population growth in the diamond industry’s important consumer markets – the US, China and India – has allowed for stable growth over the past decade, he notes.

Despite declining marriage rates, “diamond consumption by self-purchasing women is on the rise and younger generations in the US are still buying diamonds, despite a narrative that the generation is too indebted to afford luxury”, Zimnisky adds.

De Beers’ and Alrosa’s diamond sales in 2018 – at 1.5% and 5.8%, respectively –exceeded those of 2017. The two companies represent almost two-thirds of global diamond output.

Zimnisky also cites De Beers’ guidance showing incremental production increases in 2020 and 2021, “perhaps implying that the company is comfortable with diamond demand expectations in the coming years”.

Although lab-created diamonds have dominated the narrative surrounding the diamond industry’s future and survival, the success of natural diamonds has always relied on marketing and branding, as is the case with most luxury products, he says .

“For example, there was not even a Japanese word for diamond until De Beers began marketing it in the country following World War II. While Japan’s share of global diamond demand has since fallen off in recent years, it represented as much as 20% of global demand as recently as the early 2000s and has remained an important market for the industry.”

The continued existence of a robust natural diamond industry lies within the industry’s ability to continue conveying the intangible value that natural diamonds can bring to consumers, states Zimnisky. “If buying a piece of diamond jewellery was purely a fundamental purchase based on rationality, the impact of lab-created diamonds, for instance, would be much more dire.”

However, he stresses that diamond jewellery’s value is almost inherently irrational, as it based on conveying or creating an emotional response. “There [can be] significant emotional appeal . . . and the story behind a natural diamond specifically can be very compelling in [a specific] context.”

Importantly, more expensive natural diamonds have historically maintained some resale value after purchase – tied to the inherent rarity of higher-quality natural diamonds.

Zimnisky notes that the “store of value” component is unique to a natural diamond, unlike a lab-created gem, with the relative rarity of a natural diamond evident in future supply projections. “If the industry is successful in maintaining or growing demand for natural diamonds in the longer term, the question of insufficient future supply is legitimate.”

FUTURE SUPPLY

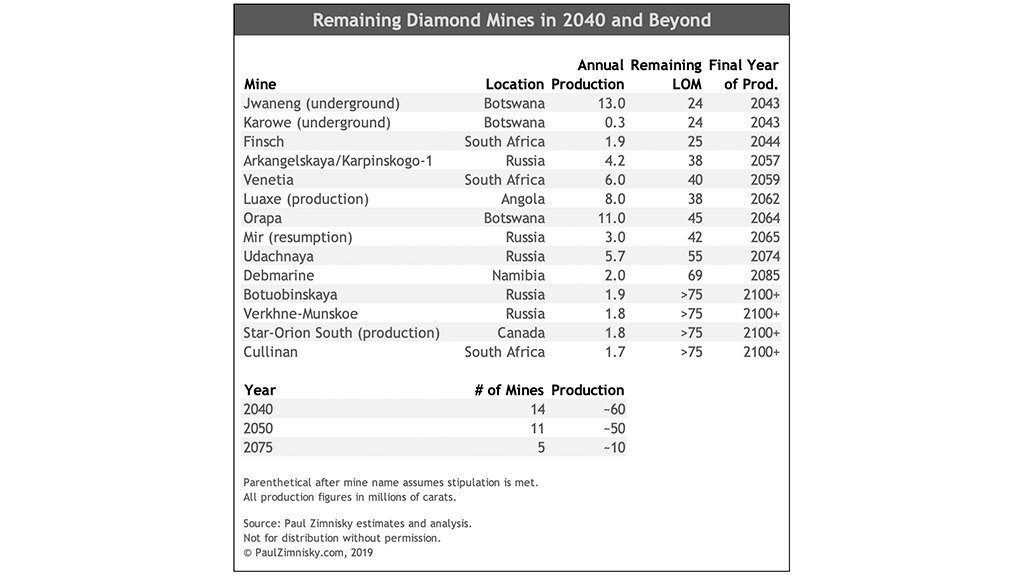

There is only one new large-scale mine in development globally and only one predevelopment project that is likely to reach production-stage within the next ten years, and about twenty existing diamond mines will reach exhaustion within the next decade.

At current diamond prices, the global portfolio of diamond mines will shrink from more than 50 commercial mines currently to about 14 by 2040, with production falling from 145-million carats to about 60-million carats in same the same period, says Zimnisky.

“To maintain what is currently a $90-billion natural diamond jewellery industry, diamond prices would have to more than double and/or jewellery margins at the end-consumer level would have to increase, in part by decreasing diamond content . . . to [support] even a nominal zero growth environment.”

However, he adds that, with sufficient demand, long-term supply projections would most likely improve: “There are undoubtedly undiscovered diamond deposits, but there are also known deposits that are simply not economic at current diamond prices”.

Higher prices would theoretically improve economics of undeveloped assets and also lead to improved profitability for existing miners and shareholders, which would consequently provide funding for new exploration and development, he states.

The diamond industry has overcome anti-trust legislation, threats from simulants, and generations of changing consumer preferences and cultures and, “given its . . . record and an environment that may not be as dire as some would make you believe, it would be prudent to think twice before giving up on the industry,” concludes Zimnisky.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation