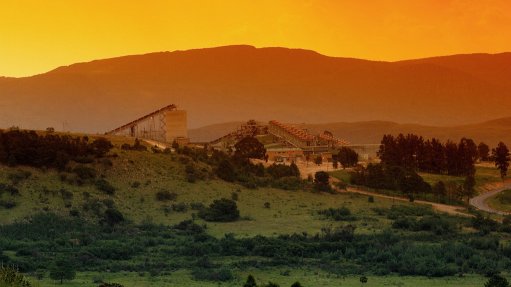

Aquarius' Everest mine

JOHANNESBURG (miningweekly.com) – Platinum miner Aquarius Platinum on Friday reported a net profit of $5.21-million for the three months ended September 30, compared with a loss of $10.19-million during the prior corresponding period. This increase was driven by a 3% rise in production, 5% higher dollar prices, lower costs and rand depreciation.

During the quarter under review, the company’s attributable production from its operating mines increased by 3% quarter-on-quarter and 4% year-on-year to 86 855 oz.

However, despite this increase in production, Aquarius reported total cost of sales of $56-million, which was 10% lower than the prior corresponding period, owing to the 7% weakening in the rand/dollar exchange rate.

The company’s Kroondal operation, in the North West, increased its production by 6% quarter-on-quarter to deliver its seventh consecutive quarterly production of more than 105 000 platinum group metal (PGM) ounces, Aquarius CEO Jean Nel pointed out.

Cash costs at Kroondal, having declined by 4% quarter-on-quarter to R9 000/oz, remained below guidance.

Meanwhile, cash costs at the Mimosa mine, in Zimbabwe, were up 1% to $815/oz quarter-on-quarter after adjusting for one-off voluntary retrenchment costs incurred in the previous quarter.

Year-on-year, the mine’s costs declined by 3%.

“Following the successful rights issue implemented earlier in 2014, Aquarius has a sustainable balance sheet with net cash. The board is of [the] view that retaining a sustainable level of debt on balance sheet is appropriate,” Nel said.

The company’s cash balance at the end of the quarter, excluding cash in joint venture (JV) entities, was $138-million.

A further $19-million was held in JV entities, 50% of which was attributable to Aquarius.