BHP’s mega bid for Anglo sets stage for industry shakeup

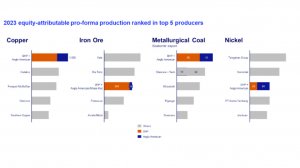

The combined entity will not only be the biggest copper miner, but also the largest metallurgical coal producer.

Photo by Wood Mackenzie

BHP has spent the last ten years simplifying their asset base only to buy one of the most complex portfolios in the industry.

Australia-headquartered BHP has made a bold move with its bid to acquire rival Anglo American in an all-share deal valued at $38.8-billion. With this manoeuvre, BHP aims to create the largest copper miner globally, but it could face scrutiny from Anglo shareholders over valuation concerns.

Commenting on the proposed deal, Wood Mackenzie mining and metals corporate research director James Whiteside remarked that the transaction would represent the biggest shakeup of the global mining industry in more than a decade.

However, he said uncertainties persist as to whether the proposed offer would meet the expectations of Anglo shareholders.

“Anglo American shareholders may consider fair value closer to the share price in 2023 before operational issues emerged and other suitors may be compelled to act at this price,” Whiteside commented.

The deal, if finalised, would mark the biggest in BHP’s history and one of the largest mergers and acquisitions across all sectors this year.

“BHP has spent the last ten years simplifying their asset base only to buy one of the most complex portfolios in the industry,” said Whiteside.

“However, this deal is all about copper and when greenfield options look limited and expensive it makes sense for [BHP] to look for more workable solutions.”

Sathiya Narayanan, a business fundamentals analyst at GlobalData, said the acquisition would help BHP to access the South American market, where it did not currently have a big presence.

BHP would gain access to three of the world’s largest copper mines - Collahuasi (with ownership of 44%), Los Bronces (50.1%), El Soldado (50.1%) and Quellaveco (60%).

News of the potential acquisition sparked investor interest, with Anglo’s stock surging by 12.3%. The combined entity’s value could surpass $200-billion, positioning it as a mining powerhouse.

Narayanan attributed BHP’s interest in Anglo to the company’s weak financial performance, driven by challenges in platinum group metals and diamond sectors due to price fluctuations, geopolitical and economic situations, as well as operational constraints.

At the same time , the company has reported growth of 31.5% in copper sales to $7.36-billion in 2023.

Anglo’s first-quarter 2024 results revealed an 11% increase in copper production to 198 100 t, fuelled by significant output boosts in Peru and Chile.

Narayanan projected operational synergies, foreseeing a combined entity with a top line of more than $84-billion, an Ebtida of more than $34-billion, and a workforce nearing 100 000, reinforcing its status as a major player in the global mining sector.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation