Kropz anticipates first phosphate ore from long-awaited Elandsfontein by year-end

Kropz CEO Ian Harebottle discuss their phosphate mining and exploration projects. Video and editing: Darlene Creamer

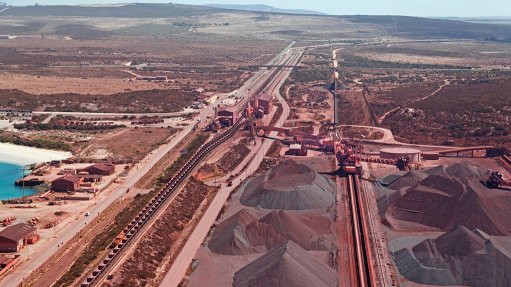

Aim-listed emerging phosphate producer Kropz is finalising the design of processing plant upgrades at its 74%-owned Elandsfontein project, in South Africa, with first ore to be produced by the end of the year.

The mine will ramp up to steady-state production of one-million tonnes a year during 2020, at a grade of around 32% phosphate rock concentrate.

The mine was initially commissioned in 2017, but stopped production soon after, as a result of the need to improve the processing plant, as well as a low phosphate price at the time.

The price has since recovered to around $95/t and is anticipated to grow at a compounded annual growth rate of 3.9% up to 2035.

The demand for phosphate is anticipated to be 297-million tonnes a year by 2035.

Kropz has spent about $120-million to date on developing the project, with a significant portion having been spent on putting green mining practices in place.

The Elandsfontein property is situated on top of an aquifer, which has raised many environmental concerns from stakeholders.

The mine pumps out about seven-million litres of water a day, which is put back into the ground at the same rate as would have naturally occurred. The company also aims to rehabilitate the ground after its projected 14-year mine life, to such an extent that it is in a better state than before mining started.

The company continuously undertakes groundwater monitoring to ensure there is no environmental disturbance.

Kropz still needs to invest $16-million – mostly on equipment – up to first ore production.

CEO Ian Harebottle said during a media briefing, on Wednesday, that the company would be well positioned to cater to the anticipated increase in demand for phosphate globally.

Phosphate is a fertiliser and farmers are increasingly under pressure to produce more food to meet the needs of the rapidly growing population, especially in sub-Saharan Africa.

Additionally, farmers have reduced arable land available and need to maximise and optimise their land use and operations, which effectively makes the use of fertiliser essential.

“Over the next 50 years, farmers will have to produce as much food as they produced in the last 10 000 years,” he added, quoting Global Harvest Initiative experts.

PHOSPHATE PIPELINE

Meanwhile, Kropz has acquired a 98% interest in Cominco – a company that holds 90% of the exploration-stage Hinda phosphate project, in the Republic of Congo.

Hinda is a sedimentary phosphate deposit covering more than 260 km2 of the country’s coastal basin. It has a Joint Ore Reserves Committee-compliant mineral resource estimate of 675-million tonnes, grading 10%, with 86% of the resource in the measured and indicated categories.

While a 2015 definitive feasibility study for Hinda targeted production of 4.1-million tonnes a year of phosphate concentrate with an unleveraged net present value of $1.85-billion and an internal rate of return of 38%, Kropz believes a smaller-scaled project targeting production of between 1-million and 1.5-million tonnes a year can be developed initially for a significantly lower capital investment with similar returns.

Harebottle anticipated a feasibility study on the project would be completed by 2020, with site works to begin in the same year to achieve first production in 2022.

He added that the company would need to raise, or borrow, between $80-million and $100-million for Hinda’s development.

Moreover, the company’s 50%-owned subsidiary in Ghana, First Gear Exploration, is undertaking exploration work to confirm that neighbouring Togo’s phosphate deposit extends into the Aflao area of Ghana’s Volta Region.

The neighbouring deposit is confirmed to stretch right up to the city of Lomé, and Kropz is investigating the area right next to the city on the other side. Kropz will soon start with more mobile metal ion geochemistry studies and launch a detailed exploration programme to delineate a resource.

In Togo, the Société Nouvelle des Phosphates du Togo’s Kpeme mine is the country’s single major producer. Kpeme’s production has averaged between 700 000 t and 1.2-million tonnes a year of phosphate rock concentrate, at a high grade, over the last five years.

Meanwhile, the company listed on the Aim in November last year, with 261-million shares in issue and a market capitalisation of more than $100-million.

Kropz envisions becoming an independent phosphate rock producer, with the capacity to deliver three-million tonnes a year, and to develop into an integrated mine-to-market plant nutrient company focused on sub-Saharan Africa.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation