Yearly gold production at Blanket was 75 416 oz and in line with guidance.

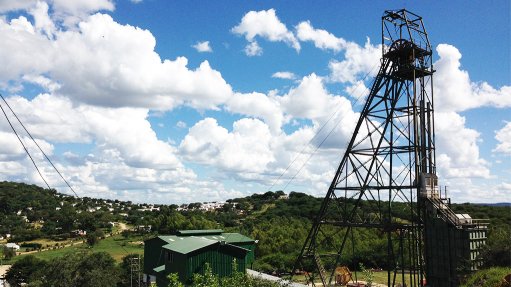

Gold miner Caledonia Mining notes in its operating and financial results for the year ended December 31, 2023, that its performance was in line with both market expectations and production guidance.

Gross revenue was $146.3-million, 3% higher than in 2022, owing to a 7.8% increase in the average realised price of gold sold.

Gross profit was $41.5-million, compared with $61.8-million in 2022, as a result of higher production costs at the Blanket mine, in Zimbabwe, of $69.6-million and operating costs at the small-scale, temporary Bilboes oxide mine of $13.1-million.

The Bilboes oxide mine was returned to care and maintenance with effect from October 1, 2023.

Earnings before interest, taxes, depreciation and amortisation were $29.7-million, compared with $50.4-million in 2022, primarily owing to the Bilboes oxide mining cost of $13.1-million and several one-off costs, including higher-than-expected labour and power costs of $5.5-million, and $2.5-million of foreign exchange losses in the year.

Net cash from operating activities was $14.8-million.

The dividend for 2023 was maintained at the same level as in 2022. The company declared a quarterly dividend of $0.14 on each of its shares, which it says reflects its confidence in Blanket’s operations and its cash generation.

Operationally, yearly gold production at Blanket was 75 416 oz and in line with guidance.

The 2024 gold production guidance at Blanket has been set at 74 000 oz to 78 000 oz.

Caledonia highlights further encouraging results from the deep-level drilling programme at Blanket, as announced in January, which is currently evaluating the continuity of the mineralised zones on the Blanket and Eroica orebodies.

Total drilling for 2023 was 13 280 m and this, together with ongoing drilling, will be reflected in a revised mineral resource statement expected to be released in the second quarter of 2024.

Meanwhile, the operating and financial performance at Blanket has been in line with management expectations in the first quarter of this year.

Caledonia is evaluating the initial results of the ongoing work on revised feasibility studies for Bilboes with a specific focus on reducing the initial capital expenditure profile, thereby enhancing the project economics.

Dana Roets left the business as COO on February 29, and a process is well-advanced to appoint a successor, the company says.

Tariro Gadzikwa has joined the board as an independent nonexecutive director.

Caledonia’s immediate strategic focus for the months ahead are to meet guidance at Blanket and produce at a similar level in 2025; and to complete a revised resource statement, thereby extending the life of the Blanket mine.

It is also aiming to complete the updated feasibility study on the Bilboes sulphide project to determine the best implementation strategy and estimate the funding requirements, as well as to start development of the project.

It will also continue with exploration activities at the Motapa exploration project.

“The performance of Blanket remains robust; operating cash flows across the second half of the year show a continuation of the improved operating performance compared to the first half of 2023. We continue to see Blanket as the solid foundation for growth as we pursue our strategy to become a multi-asset gold producer,” CEO Mark Learmonth says.

“Caledonia’s vision has evolved over the last couple of years from being a relatively small operator of a single asset towards a strategy focussed on becoming a multi-asset, Zimbabwe-focussed gold producer with an ambition to produce over 250 000 oz of gold per annum. The acquisition of Bilboes in January 2023 builds on the earlier acquisitions of Motapa and Maligreen to create a portfolio of high-quality exploration and development assets in Zimbabwe.

“I look forward to announcing the results of the updated feasibility study for the Bilboes sulphide project soon and firmly believe that we have the potential to create and deliver greater shareholder value from the future inclusion of this project in our production profile,” he adds.