Energy Fuels preparing two more US uranium mines for production

In anticipation of continued strength in uranium markets, US-based Energy Fuels is preparing two more mines in Colorado and Wyoming for production and is readying for exploration drilling to increase resources.

This follows hot on the heels of the company starting production in late 2023 at Pinyon Plain, in Arizona, as well as La Sal and Pandora, in Utah. Once production is fully ramped up at these three mines by mid- to late-2024, Energy Fuels will be producing at a run-rate of 1.1-million to 1.4-million pounds a year of uranium oxide.

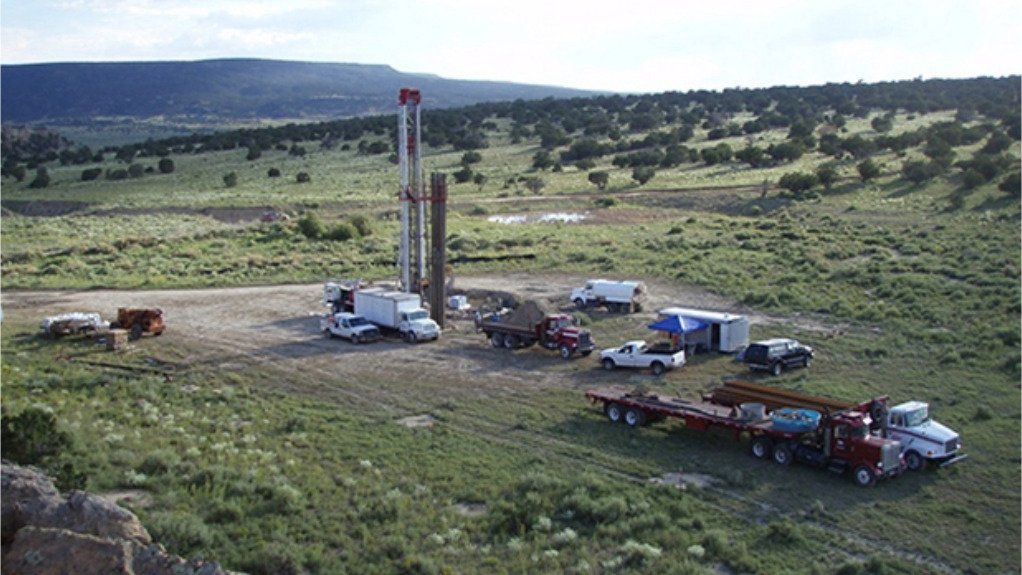

The additional mines expected to enter production within the next year are Whirlwind, in Colorado, and Nichols Ranch, in Wyoming, These two mines could potentially increase production to a run-rate of more than two-million pounds a year by as early as 2025.

“We have a bullish long-term view of uranium prices, and we are investing to increase production,” said president and CEO Mark Chalmers.

Energy Fuels is planning a drilling programme at its Nicholas Ranch project and an underground delineation drilling programme at Pinyon Plain to increase resources at those projects.

At the same time, the miner is advancing permitting efforts at three of its large-scale uranium mines - Roca Honda, Sheep Mountain and Bullfrog – which Chalmers said could increase company-wide production to a run-rate of up to five-million pounds a year in the next several years.

Chalmers stated that Energy Fuels’ nimble business plan enabled it to capture opportunities in the uranium market as prices began to surge in late 2023.

During 2023, the company sold 560 000 lb of uranium for about $60/lb, generating total gross profits of $17.96-million and a 54% gross margin.

However, uranium prices have risen significantly since then, and in the first quarter of 2024, Energy Fuels intends to sell about 300 000 lb of uranium under long-term contracts and on the spot market at an expected weighted average sales price of $84.38/lb and at substantially higher gross margins.

“As long as market prices are strong, we will continue to selectively capitalise on spot market sales opportunities as we ramp up our production, in ways that are unique to our company, in 2024 and beyond, and with limited capital,” said Chalmers.

Further, he said that Energy Fuels had joined an “exclusive club” last year, when it reported net income of nearly $100-million.

“We became one of the only profitable non-State-owned uranium mining companies in the world.”

While capturing opportunities in uranium, Energy Fuels is also advancing its rare-earth elements (REE) initiatives, with modifications at the White Mesa mill under way to enable the company to produce high-purity separated REE oxides from monazite feed.

The Phase 1 modification and enhancements to the existing solvent extraction circuits at the mill are expected to be completed on-schedule, and $7-million to $9-million below budget, by the end of the first quarter.

Subject to securing sufficient monazite feed, Phase 1 is expected to position Energy Fuels as one of the world's leading producers of separated neodymium-praseodymium (NdPr) outside of China.

The mill’s Phase 1 REE circuit is expected to have the capacity to produce about 800 t/y to 1 000 t/y of separated NdPr oxide.

During the second quarter, the comopany expects to produce about 25 t to 35 t of NdPr oxide to commission and optimise the NdPr circuit, after which time the firm expects to begin processing uranium ore and alternate feed materials for the large-scale production of uranium at the mill for the remainder of the year.

"We believe now is the right time to secure a strategic position in the REE space, since REE prices are at relatively low levels, and because our unique ability to process radioactive ore at the mill gives us a durable competitive advantage," said Chalmers.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation